I’ve found a FTSE 250 company that I think could be a really interesting investment. It’s quite unusual as a choice for me, particularly because of its low growth. However, its good earnings and high dividend yield, as well as a compelling valuation, make it look like an opportunity to me.

A look at ITV

The company in question is ITV (LSE:ITV). As of 2024, its strategy includes a shift towards more digital offerings. It’s doing this through the expansion of ITVX, which was formerly ITV Hub.

Also this year, its production arm, ITV Studios, continued to perform well, particularly by growing revenues. This is significant considering the company’s growth is less than stellar overall, so it shows some resilience to the overall slowdown.

Should you invest £1,000 in ITV right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if ITV made the list?

However, its media and entertainment segment saw a reduction in revenue. This is the department responsible for broadcasting and digital services. Largely, this can be attributed to lower broadcasting popularity, which is why the company is looking to shift its strategy to more streaming.

To show the success inherent in a digital-first strategy, the firm has reported good growth in digital advertising revenue recently.

What I like about it

I think there are a lot of elements for me to feel confident about when investing in ITV. For example, its net margin is 7.5% right now, which is in the top 30% of companies in its industry.

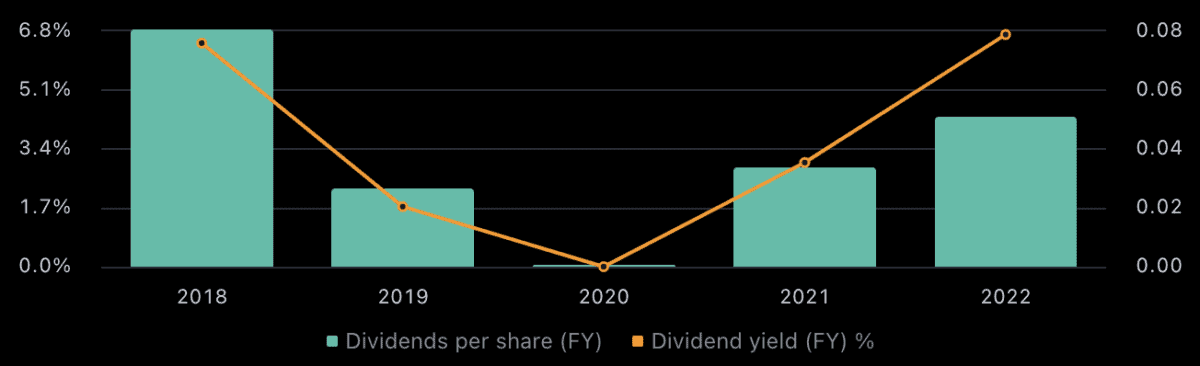

Those high earnings also help support its nice 8.5% dividend yield in 2024. However, it’s not common for its yield to be so high. Notably, it was down around the time of the pandemic, and over the last 10 years, it has been around 3.7% on average.

Also, the valuation at the moment looks very compelling to me. Currently, its price-to-earnings ratio is just six, much lower than 13, which is what is normal in the industry right now.

The risks I can see

The most obvious risk to me is that the company’s balance sheet could be stronger. It has equity of just 39% of assets, meaning it has a lot of debts to deal with. This makes it slightly vulnerable in the event of future economic crises.

Also, its free cash flow has decreased at a rate of 17.6% per year on average over the last three years. This means that it is losing financial agility. Coupled with the balance sheet weakness, it does present some concern to me.

My verdict

If I was a passive income investor looking for a strong dividend, I think ITV might be a good choice for me at the moment.

The financials do look good enough for me to potentially consider it as a value investment. However, the company doesn’t seem to be convincing investors at large.

In fact, the share price has been in a long-term downtrend for around 10 years. If I do invest, it would be on the expectation of a revitalisation in the business for the extended future.

I’ll be watching it carefully, but for now, it’s only on my watchlist.